HST is in full effect and I know potential real estate buyers in BC wants to know how it will affect their home purchases. Here are the most commonly asked questions and the right answers.

Does the HST apply to all housing?

The HST only applies to “new” residential housing; used (i.e., resale) residential housing is not subject to HST.

Is BC providing a rebate for new housing?

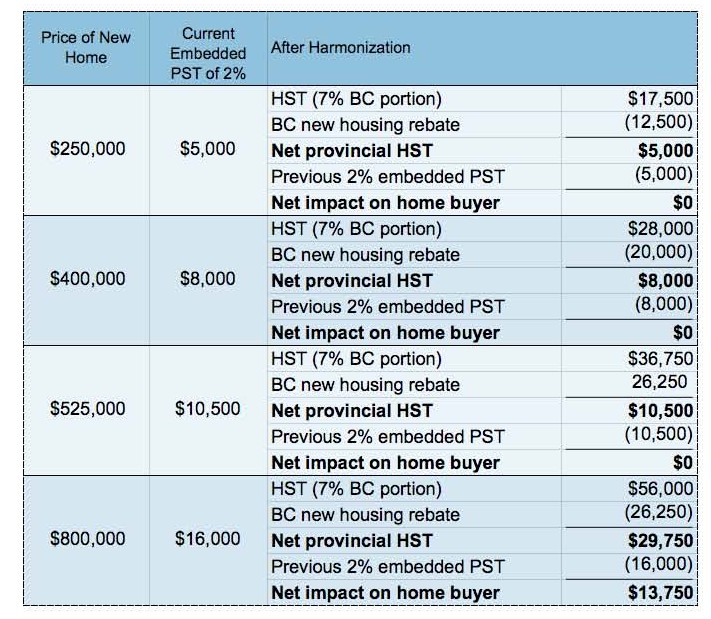

BC will provide a rebate for new housing purchased as a primary residence to ensure that, on average, purchasers of new homes up to $525,000 do not pay any additional tax due to harmonization. That is, they will pay no more in provincial HST than is currently embedded as PST in the price of a new home.

The rebate is available whether the new housing is to be owner occupied or rented.

How much is the new housing rebate?

The rebate will be 71.43% of the provincial portion of the HST, up to a maximum rebate of $26,250.

Purchasers of eligible new homes above $525,000 will be eligible for a rebate of $26,250 (i.e. a rebate on the first $525,000 of value).

Which types of housing are eligible for the rebate?

The BC new housing rebate will be available for all types of housing currently eligible for the federal GST/HST new housing rebate and will be subject to the same eligibility conditions.

Qualifying housing generally includes newly constructed and substantially renovated homes used as a primary place of residence by an individual (or qualifying relation of the individual).

Is there any rebate for new rental housing?

To support affordable rental housing in the province, BC will also provide a new rental housing rebate of 71.43% of the provincial portion of the HST, up to a maximum rebate of $26,250 per unit.

Who is eligible for the new rental housing rebate?

The new rental housing rebate will be provided to landlords who construct or substantially renovate their own rental housing and, as a result, are required to self–assess and pay HST under the self–supply rules.

The rebate will also be provided to landlords who purchase newly constructed or substantially renovated rental housing in BC and pay HST on the purchase.

Which types of rental housing are eligible for the rebate?

The new rental housing rebate will be available for all types of new or substantially renovated rental housing currently eligible for the federal GST/HST rebate for new residential rental properties, and will be subject to the same eligibility conditions.

Why isn’t the rebate rate 100%?

New housing is not directly subject to PST (i.e. the purchaser of a new home does not pay PST on the purchase price). However, builders have to pay PST on most construction materials (e.g. wood, cement, plaster, nails, etc.) used to build a home. The PST is part of the cost of building the home and included (embedded) in the total selling price of the home. It is estimated that the embedded PST in new homes in British Columbia is – on average – equal to about 2% of the price.

Unlike with the PST, under the HST there will be no sales tax embedded in the price of new homes because builders, like most other businesses, will recover the HST they pay on their materials through input tax credits. Without a rebate, the provincial tax on new homes would have effectively increased from about 2% on average (embedded PST) to 7% (provincial portion of the HST).

The rebate rate was set to ensure purchasers of eligible new homes up to the $525,000 threshold pay no more provincial HST on average than under the PST.

Rebate rate: (7% BC HST minus 2% embedded BC PST) / 7% BC HST

Rebate rate = 5/7 = 71.43% of provincial portion of HST paid, to a maximum of $26,250.

Total Sales Tax Payable on New Homes

I really liked the article. It’s always nice when you can not only be informed, but also entertained!